Mobile e-commerce is exploding. In the US, 56% of people already own smartphones. Internationally, adoption projections for countries like China show this trend is just beginning. Unfortunately, with the increasing limitations on mobile device fingerprinting, mobile e-commerce fraud detection has also become more complex.

Less data, mo problems

Mobile fraud suffers from two data-related problems: merchants ask for less customer information and the device data they do collect is less useful. Merchants request less info because conversion stands as their greatest challenge. Specifically, mobile customers give up nearly half their shopping attempts because the process takes too long. While the prioritization of conversion and growth over fraud detection is understandable, merchants are increasing their risk.

Besides the fact that some traditional signals are unavailable on mobile devices (e.g. IP-based location), merchants are finding that remaining data is often insufficient. In May, Gartner estimated that ~40% of mobile devices could not be uniquely identified…quite problematic as fraudsters shift to mobile along with legitimate customers.

Unique mobile e-commerce fraud detection patterns

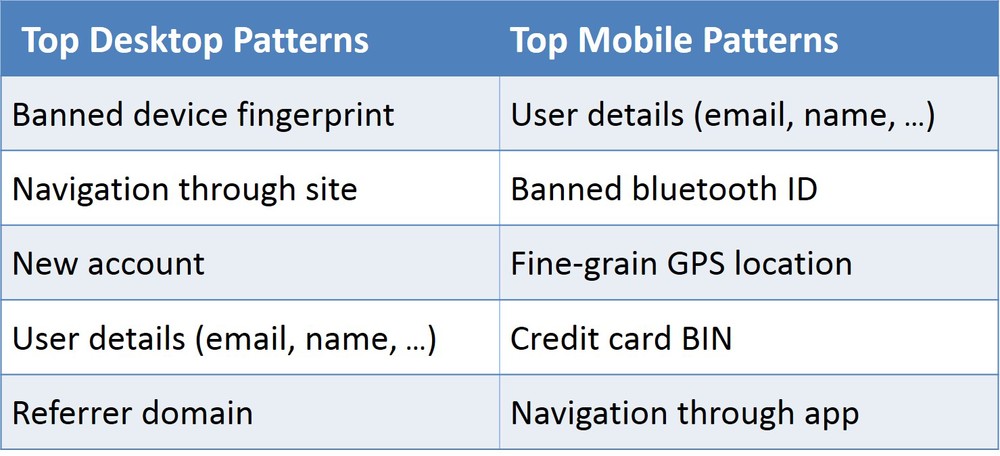

Large-scale machine learning solutions like Sift Science provide a competitive advantage due to their breadth and flexibility. Two examples from our data illustrate machine learning’s power in e-commerce fraud detection. First, when comparing top fraud signals for a desktop web site to a mobile app, we found almost entirely different predictive fraud patterns (see table).

Notably, while behavior matters in both environments, the nature of in-app navigation requires a detection solution able to take into account the unique way each app is designed. At Sift, we do this by accepting custom events. These are crucial in understanding whether a customer is a potential fraudster. The results also make a strong case for capturing more data, given the potential for any pattern to be predictive in detecting fraud.

New accounts: always riskier?

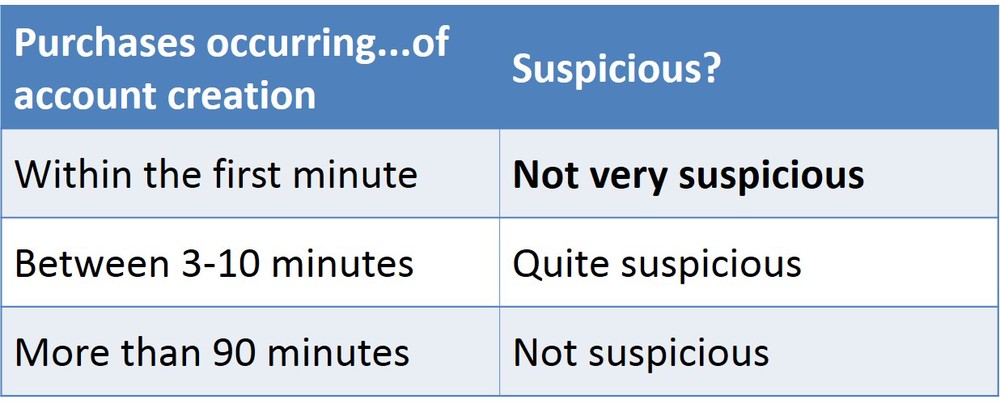

As a second example, consider the common belief that transactions from newly created accounts are riskier. In fact, our system uncovered a more nuanced reality, one difficult to detect without machine learning.

Why might this be? Many sites have a “sign up when you make your first purchase” option that’s used by legitimate customers. In contrast, fraudsters tend to create accounts and then go shop for merchandise. Of course, time ranges will differ between companies, so custom variables are crucial for a fraud detection system.

These mobile e-commerce fraud detection insights demonstrate how a large-scale machine learning based solution not only catches more fraud, but also more efficiently identifies legitimate customers. Check back here often (or sign up for our email list) because we’ll be covering other fraud-related topics in future posts, such as technical aspects of mobile fraud and a look at fraud by country.